You've been Trump Tango'd but don't worry, you've got this.

The people losing their shirts and their minds on Wallstreet today will tell you “stability is the bedrock of prosperity.” While this might be the right advice for anyone with their wealth tied up in stocks and shares, for those of us who make our living as estate agents, I say, give me a good storm any day. Give me a black swan. Give me the chaos that reshuffles the deck.

"For those of us who make our living as estate agents, I say, give me a good storm any day. Give me a black swan. Give me the chaos that reshuffles the deck."

I covered this recently on Simon Gates’s rather excellent podcast series (excellent in its own right, not just excellent because I was on it). Stability does very little for the property market. I’ve always argued that disruption, however unsettling, is the lifeblood of the property market. And frankly, for those of us in the trenches – the estate agents, the mortgage brokers, the dealmakers – a calm sea is a deathly still one.

Putting it bluntly, it’s human nature. When people are content with their current situation, when life is so boring that they end up feeling ambivalent about the prospects of moving, the property market tends to stagnate. There’s no urgency, no need to relocate, and transactions grind to a halt. The absence of urgency breeds a sense of 'why bother?' and the market remains stubbornly still.

You saw this as plain as day during the post-COVID boom. A global tragedy, undeniably, but a seismic shift in lifestyle and priorities. Suddenly, everyone wanted a garden, a home office, a fresh start. The pent-up demand, coupled with historically low interest rates, created a frenzy. It wasn't about 'good' or 'bad'; it was about movement. And movement, in our business, translates to opportunity.

Even the credit crunch, a period of profound economic pain and certainly the biggest disrupter to the mortgage markets that we’ve ever seen, generated activity. Desperation, necessity, and the sudden, sharp drop in variable interest rates – a phenomenon we may never witness again – forced transactions to happen. It wasn't a pretty picture, but it was a picture nonetheless. People moved, downsized, relocated, and restructured their lives. We facilitated that change, and we found our market once again, and I think it’s fair to say, the market recovered more quickly than we ever expected it to. The banking rules had changed, we had re-written all the things we thought we could rely on. Affordability, stress testing, yield calculations - everything you once held dear was thrown out of the window.

Now, we find ourselves in a peculiar position, caught in the crosswinds of a global economy increasingly influenced by the volatile policies emanating from across the Atlantic. Trump's tariffs, those blunt instruments of economic nationalism, have sent ripples through global supply chains, impacting everything from raw materials to consumer goods. The resulting inflationary pressures, coupled with the Federal Reserve's response, are inevitably going to have a domino effect that reaches our shores. The government and the Bank of England will be forced to react, and that means uncertainty, and potentially, higher inflation, volatility in interest rates. This is not a stable environment, and for your business, that’s not necessarily a bad thing.

The fear of the unknown, the spectre of rising mortgage payments, the potential for economic slowdown - these are just some of the catalysts that shake people out of their complacency. Suddenly, that 'perfectly adequate' home doesn't seem so perfect anymore. Suddenly, the need to downsize, to relocate, to secure a more stable financial footing becomes paramount. On the other hand, all your previously smug mates who were doing very clever things on the stock market, that you did’nt really understand are waking up to half their net worth being wiped off the ledger, pretty much over night. And all the steady Eddies who chose property as their long term gamble, well the market goes up and it goes down, but not as violently as a day with Trump on Wall Street. But regardless of who you are and where you choose to invest, who's there to guide the average homeowner or investor through this process? You are and you get to be the calm, experienced voice in a sea of chaotic uncertainty. They won’t show you that on the annual veracity index, but it is as true as anything.

And while the long-term effects of US economic policy may spell volatility, there's a fascinating short-term anomaly at play: falling swap rates. For those unfamiliar, these rates underpin fixed-rate mortgages. A dip here could translate to more attractive mortgage deals, temporarily injecting a surge of activity into the market. You might even see a flurry of first-time buyers and those looking to remortgage, seizing the opportunity before the anticipated wider economic headwinds truly bite. This creates a window of opportunity, a brief but potent surge in demand, that savvy agents can, and should capitalize on. It’s a delicate dance, balancing the immediate potential for helping clients secure a better deal, with the looming uncertainty that requires a more cautious, advisory approach. Knowing when to strike, and when to advise caution, is key. Because at the end of the day, helping people through these times is what you do best.

But when it comes to talking about global exports, the credit crunch, a defining moment of economic devastation, was effectively an American export. The subprime mortgage crisis, born on Wall Street, cascaded across the Atlantic, leaving a trail of destruction in its wake. It reminds us, as Brexit continues to remind us, that economically, we are not an island and cannot afford to be.

"A three bed semi in some forgotten corner of suburbia might not seem as glamorous The City, but right now it’s looking like a far safer bet."

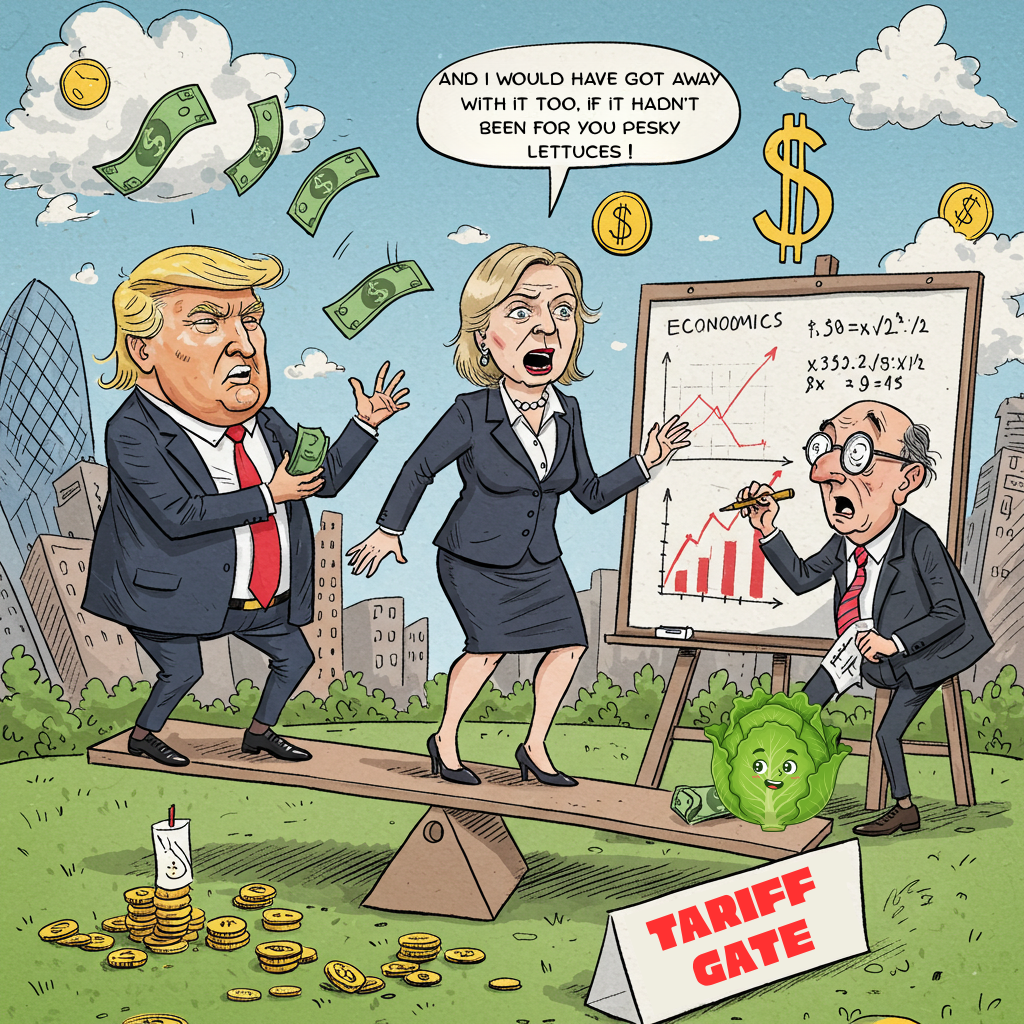

So do we get to have our “I told you so” moment with the Trump supporters, blaming all of this economic mess on our cousins across the water? Well, as the bible says, “let he who is without Liz Truss cast the first stone.” If Trump’s economic policies are not redolent of Truss, then I don’t know what is. The echoes of ‘Trussonomics’ resonate eerily with ‘Trumpenomics’. Both are fuelled by a similar brand of political theatre, a desire for bold, headline-grabbing moves, regardless of the potential fallout.

Listen to Truss on the circuit these days, speaking deep within the MAGA heartland, and she unabashedly parrots the Trumpian playbook. It’s a narrative where some nebulous ‘woke left-wing conspiracy’ is responsible for economic ruin, rather than the reality of reckless fiscal gambles. Of course, the lettuce that famously outlasted the Truss premiership says otherwise.

"It’s like watching the economy get ‘Tango’d’ – suddenly, grotesquely orange, and hit with a chaotic, unpredictable force that leaves everyone spluttering and wondering what just happened."

It’s a pursuit of headlines, good or bad, a quest for attention that often seems to supersede sound economic policy. One could say, they both are experts at creating their own reality tv show, and the economy is the unwilling star. It’s like watching the economy get ‘Tango’d’ – suddenly, grotesquely orange, and hit with a chaotic, unpredictable force that leaves everyone spluttering and wondering what just happened.

For estate agents, these moments are opportunities to offer a sound minded alternative to the roller coaster ride that is the FTSE index. The truth is, you already know how to react and remain calm under uncertain economic pressure. Hell, it is the story of your lives. A three bed semi in some forgotten corner of suburbia might not seem as glamorous The City, but right now it’s looking like a far safer bet.

To paraphrase Kipling, “If you can keep your head when all about you are losing theirs, well you’ll probably make a fine estate agent.”

Find out more about how Kerfuffle can help your estate agency business book in a call here: https://calendly.com/d/cfq-n9c-3xy/book-supplier-review-mot